Debit Card vs Credit Card Difference: People no longer need to keep money in cash, as digital banking has made shopping, traveling and many other things easier these days. Which includes financial transactions. Such things have been made easy. Bank issued credit and debit cards have made digital banking very easy. Nowadays, swipe machines have come in big businesses like malls, movie theaters, hotels, and many other places, so that people don’t need to carry cash. You can easily pay through debit and credit cards.

NOTE: YOU CAN READ THIS ARTICLE IN ANY LANGUAGE

Everyone has a credit card these days and can use it everywhere. However, paying by credit card and debit card offers double benefits. But, you may feel that which of these two cards is suitable for you and which card can benefit you more. Debit card or credit card let us know about it.

Debit Card vs Credit Card Difference

Many people do not understand which option between debit and credit cards can be better or which card gives us more benefits. Because nowadays, all financial transactions have become easy due to digital banking. People do not need to withdraw money from ATM for any item or purchase. And all this he can do through digital bank. Debit card vs credit card difference is fees, interest rate and late payement charges.

Both debit card and credit card satisfy our need. And both cards in their own right give you the freedom to make transactions. But both have their own distinct advantages. You should know the benefits of both so that you can complete your transaction keeping these benefits in mind while using the card. There is big debit card vs credit card difference.

Benefits of Debit Card

- With debit cards, you can make purchases and withdraw money from the bank.

- It can be used by people who control their expenses and spend money wisely.

- Debit cards are popular in India and are accepted across the country.

- Initiatives like Digital India and Unified Payments Interface (UPI) have promoted the use of debit cards.

- Debit cards are seamlessly integrated with the UPI platform and instant and secure transactions can be made through mobile banking apps.

Benefits of Credit Card

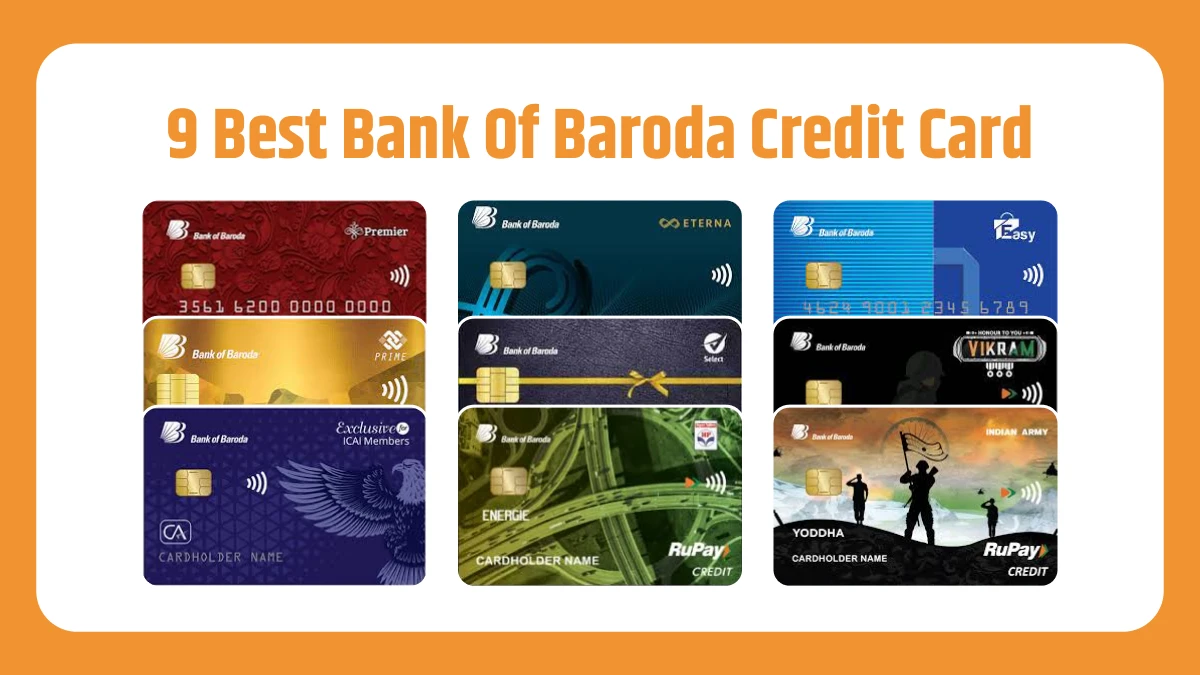

- Credit cards offer many benefits like attractive reward points, cashback offers, shopping and travel benefits.

- Credit cards provide different offers for use in different categories in which you also get discounts.

Credit cards are a popular option for Indian consumers. - Caution should be exercised when using credit cards, as outstanding balances or late payment fees may apply.

- In terms of card security, both debit and credit cards offer security measures like PIN based transactions, two-step authentication and SMS alerts.

Difference between Debit and Credit card

Debit Card:

- Directly linked to your savings account.

- Spending limit depends on the available balance in your savings account.

- It charges no interest as it uses your own money.

- There is no penalty for late payments as there is no loan involved.

- There is no annual fee charged in most cases.

- Offers the benefit of discounts and cashback on online shopping.

Credit Card:

- Issued with a credit limit which is set by the bank or issuing company.

- The spending limit is pre-defined, which allows you to spend up to that amount.

- If you do not make regular payments, interest may apply.

- There may be a penalty for late payments.

- An annual fee may be charged on some credit cards.

- Offers benefits like discounts, cashback, reward points, lounge access, etc.

Debit card vs credit card difference with credit card have limit but debit card have no lmit for expense. You can spend that you have money in your savings account.

- IndusInd Tiger Credit Card Benefits and Features

- Kissht App: Get 2 Lakh Instant Cash Loan | Quick Approval

- Cred Loan: Get 10 Lakhs Instant Personal Loan | Quick Cash

- Get 10,00,000 Loan On Bharatpe Personal Loan | Instant Approval, Quick Cash

- Navi Personal Loan: Get 20 Lakh In Low Interest | Quick Money Transfer

Which of These Two Cards is Better?

Which of these two cards is right for you depends on different factors. Debit card is the best option for banking and UPI transactions.

People who spend rather than save. Debit card is suitable for them.

Credit cards also offer you many benefits, but due to their fees, charges and interest rates, you have to be very careful when spending them.

In the end, let us say that both these cards are good in their own place. You can use both these cards as per your need.

Conclusion

Debit card vs credit card difference, Bank issued credit and debit cards have made digital banking very easy. Nowadays, swipe machines have come in big businesses like malls, movie theaters, hotels, and many other places, so that people don’t need to carry cash. You can easily pay through debit and credit cards.

You may also like

- Best Credit Card for Withdraw Cash in India 2024 – Charges, Interest Rates & Features

- How To Link Visa Credit Card To UPI, 6 Step Guide Easily Link your credit card to UPI Apps