The stock market has been experiencing significant downturns recently. Many investors are worried and trying to understand the reasons behind this trend. There are several factors contributing to the decline. Let’s explore these reasons in detail.

Economic Uncertainty

One major reason for the stock market’s poor performance is economic uncertainty. When the economy is unstable, investors become nervous. This nervousness leads them to sell their stocks, causing prices to drop. Several issues are contributing to economic uncertainty right now.

Inflation Woes

Inflation is a significant concern. Inflation means that prices for goods and services are rising. When inflation is high, the value of money decreases. People can buy less with the same amount of money. This affects companies because their costs go up. They might need to pay more for raw materials, transportation, and wages. As a result, their profits might decrease, leading to lower stock prices.

Interest Rates

To combat inflation, central banks often increase interest rates. Higher interest rates make borrowing more expensive. Companies that rely on loans for growth or daily operations find it harder to get cheap money. This can slow down their expansion and reduce profits. Investors anticipate these challenges and sell off stocks, leading to market declines.

Geopolitical Tensions

Another factor affecting the stock market is geopolitical tension. Events around the world can have significant impacts on markets.

War and Conflict

Conflicts and wars in various regions can disrupt global supply chains. For example, a war in a country that produces a large amount of oil can cause oil prices to spike. High oil prices affect transportation and manufacturing costs worldwide. Investors get worried about these disruptions and the increased costs for companies, leading to stock sell-offs.

Trade Disputes

Trade disputes between major economies, like the United States and China, also create uncertainty. Tariffs and trade barriers can hurt companies that rely on international trade. If businesses can’t sell their products easily or face higher costs, their earnings might drop. This leads to lower stock prices.

Corporate Earnings

Company performance plays a crucial role in stock prices. When companies report poor earnings, their stock prices usually fall.

Profit Margins

Many companies are seeing their profit margins shrink. This means they are making less money on each sale. Rising costs for materials, labor, and shipping are cutting into profits. If companies can’t pass these costs onto consumers, their earnings suffer. Lower earnings reports scare investors, who then sell off stocks.

Missed Expectations

Analysts make predictions about how well companies will perform. When companies don’t meet these expectations, their stock prices often drop. Recently, many companies have missed their earnings targets. This trend contributes to the overall market decline.

Technological Changes

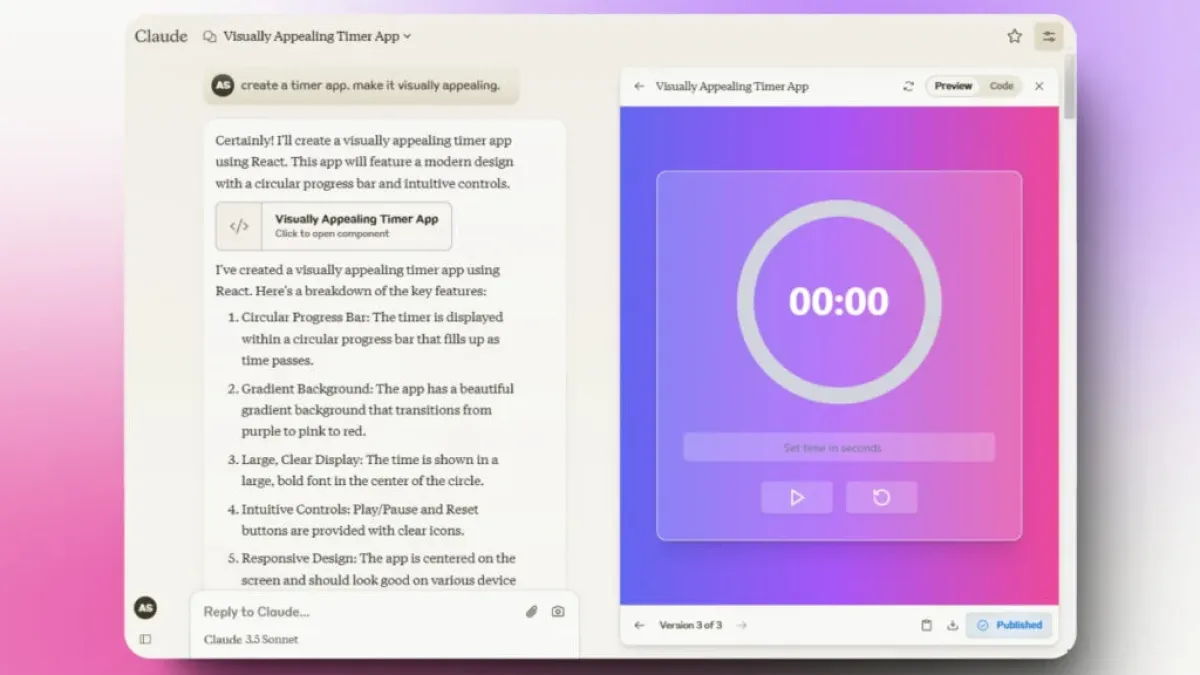

Technology plays a significant role in the stock market. Changes in technology can create uncertainty and impact stock prices.

Cybersecurity Threats

Cybersecurity threats are a growing concern. Companies must invest more in protecting their data and systems. This increases their costs and can reduce profits. Additionally, if a company suffers a significant cyberattack, it can lose customer trust and face legal consequences.