Financial planning is a crucial part of managing your money. It helps you make the most of what you have. With good planning, you can achieve your financial goals. This guide will help you understand the basics of financial planning.

Understanding Financial Planning

Financial planning means thinking ahead about your finances. It involves setting goals, making a budget, and saving for the future. This process helps you stay on track with your money. It can also reduce stress and give you peace of mind.

Setting Financial Goals

The first step in financial planning is setting goals. These goals can be short-term or long-term. Short-term goals might include saving for a vacation or paying off credit card debt. Long-term goals could be buying a house or saving for retirement.

Making a Budget

After setting your goals, the next step is to make a budget. A budget is a plan for how you will spend your money. It helps you see where your money is going and where you can save. To make a budget, list your income and expenses. Then, see if you are spending more than you earn. If you are, look for ways to cut back.

Saving for the Future

Saving money is a key part of financial planning. It helps you prepare for unexpected expenses and reach your goals. Try to save a part of your income each month. Even a small amount can add up over time.

Emergency Fund

An emergency fund is money set aside for unexpected expenses. This could be car repairs, medical bills, or job loss. Having an emergency fund can keep you from going into debt. Aim to save three to six months’ worth of living expenses.

Investing

Investing is another important part of financial planning. It can help your money grow over time. There are many ways to invest, such as stocks, bonds, and real estate. Before you invest, do your research. Make sure you understand the risks and rewards.

Managing Debt

Managing debt is crucial for good financial health. Debt can be a burden if not handled properly. Here are some tips for managing debt:

Pay More Than the Minimum

If you have credit card debt, try to pay more than the minimum payment each month. This will help you pay off your debt faster and save on interest.

Consolidate Debt

If you have multiple debts, consider consolidating them. This means combining all your debts into one loan. It can make it easier to manage your payments.

Avoid New Debt

While paying off your current debt, try to avoid taking on new debt. This can help you stay focused and make progress.

Planning for Retirement

Planning for retirement is an important part of financial planning. Start saving for retirement as early as possible. The sooner you start, the more time your money has to grow. Consider different retirement accounts, such as 401(k)s or IRAs.

Employer-Sponsored Plans

Many employers offer retirement plans, like a 401(k). If your employer offers a match, try to contribute enough to get the full match. This is free money that can help your retirement savings grow.

Individual Retirement Accounts (IRAs)

An IRA is another option for retirement savings. There are traditional IRAs and Roth IRAs. Each has different tax benefits. Research which one is best for you.

Protecting Your Finances

Protecting your finances is another key aspect of financial planning. This involves insurance, wills, and legal documents.

Insurance

Insurance can protect you from financial loss. Common types of insurance include health, car, home, and life insurance. Make sure you have enough coverage to protect your assets.

Wills and Legal Documents

Having a will and other legal documents is important. A will ensures your assets go to the people you choose. Other documents, like a power of attorney, can help manage your affairs if you are unable to.

Seeking Professional Help

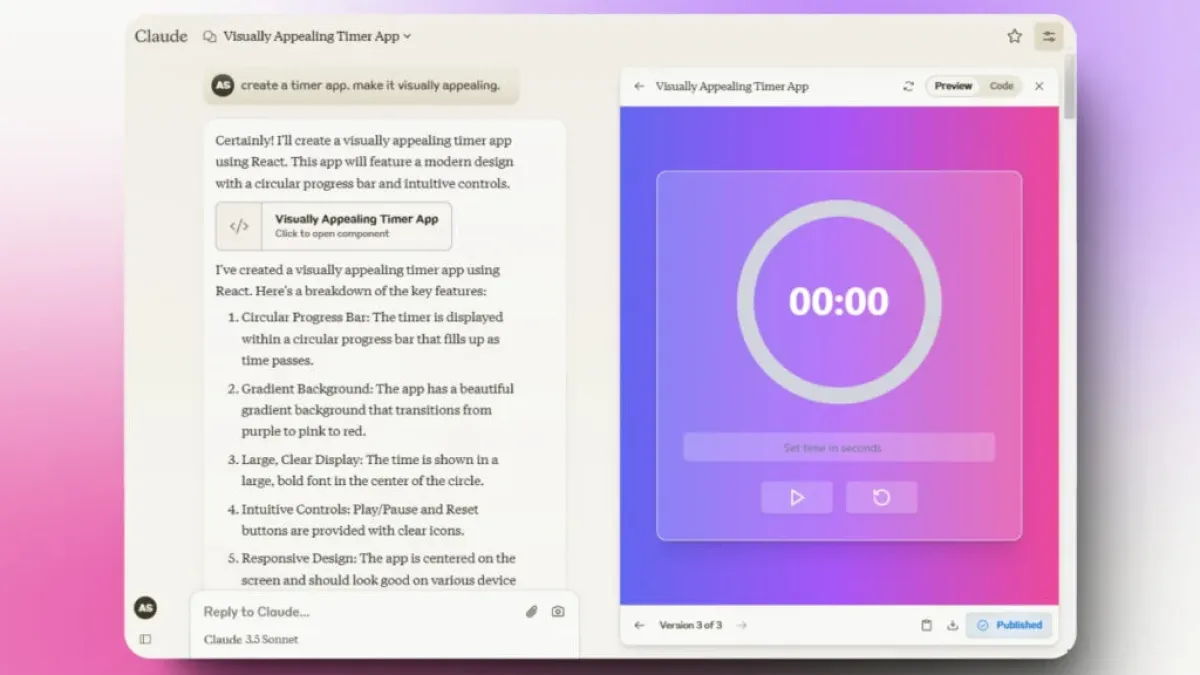

Sometimes, financial planning can be complex. It’s okay to seek professional help. A financial advisor can provide guidance and help you create a plan.

Choosing a Financial Advisor

When choosing a financial advisor, look for someone with good credentials. Check their background and ask for references. Make sure they have your best interests in mind.

Working with a Financial Advisor

When working with a financial advisor, be open and honest about your financial situation. Ask questions and make sure you understand their advice.

Staying On Track

Finally, it’s important to stay on track with your financial plan. Review your plan regularly and make adjustments as needed. Life changes, and your financial plan should change too.

Regular Reviews

Review your financial plan at least once a year. Look at your goals, budget, and savings. Make sure you are on track.

Adjusting Your Plan

If your situation changes, adjust your plan. This could be a new job, a new baby, or other life events. Keeping your plan up to date will help you stay on track.

In conclusion, financial planning is an ongoing process. It involves setting goals, making a budget, saving, and protecting your finances. By following these steps, you can achieve your financial goals and enjoy peace of mind.