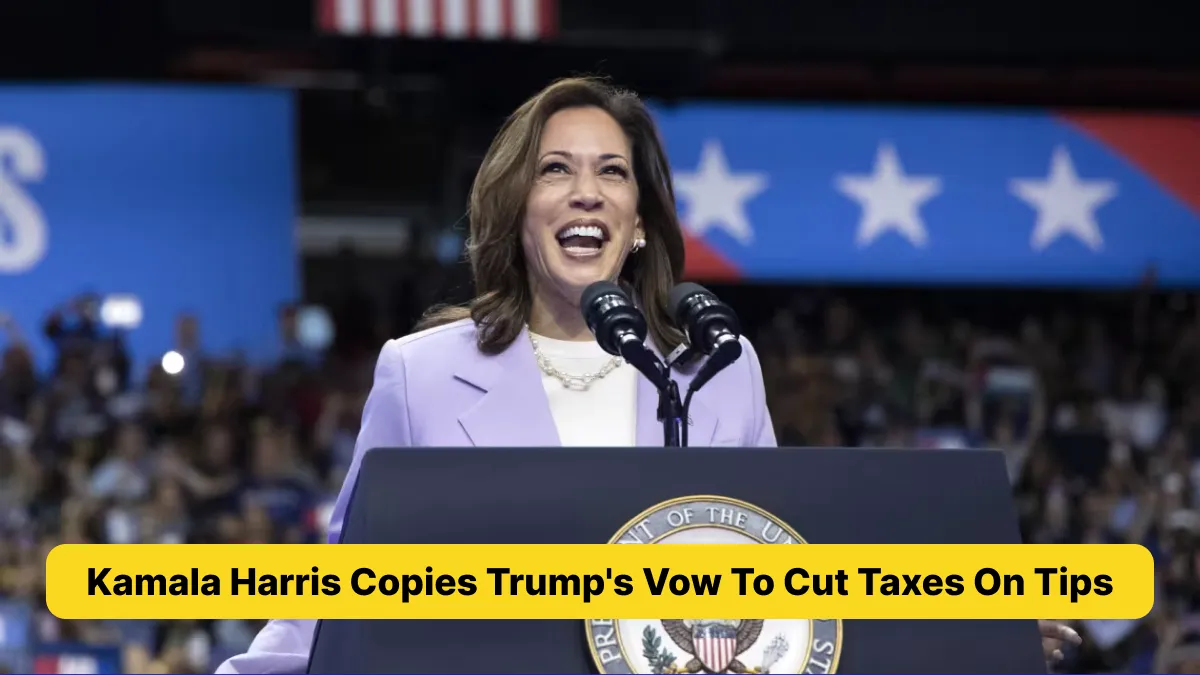

In a move that has captured the attention of many, Vice President Kamala Harris recently announced her support for cutting taxes on tips. This policy is strikingly similar to a promise made by former President Donald Trump during his time in office. Harris’s announcement has sparked conversations across the nation, as many see it as a way to support low-income workers, particularly those in the service industry.

The Announcement

Vice President Harris made the announcement during a public event last week. She emphasized the importance of helping workers who rely heavily on tips for their income. In her speech, she pointed out that many service workers, such as waiters, bartenders, and hotel staff, depend on tips to make ends meet. Harris stressed that by reducing taxes on these tips, the government could help these workers keep more of their hard-earned money.

Harris stated, “Our workers deserve a fair deal. They work hard, often for long hours, and rely on tips to support their families. It’s only right that we reduce the tax burden on their tips so they can keep more of what they earn.” Her words were met with applause from the audience, which included many service industry workers.

A Nod to Trump’s Policy

Interestingly, Harris’s proposal closely mirrors a policy that former President Donald Trump advocated during his time in office. Trump had proposed cutting taxes on tips as part of his broader tax reform plan. His proposal aimed to support workers in the service industry by allowing them to keep more of their income.

While Trump’s proposal gained some attention, it never fully materialized into law. However, it did leave a lasting impression on many, especially those within the service industry. Harris’s recent announcement has revived this idea, leading some to believe that it could finally become a reality.

The Impact on Service Workers

Reducing taxes on tips could have a significant impact on service workers. Many of these workers earn a base wage that is lower than the minimum wage, with tips making up a substantial portion of their total income. For instance, a waiter might earn $2.13 per hour in base pay, with tips adding up to bring their earnings closer to a livable wage. However, these tips are currently subject to taxes, which can significantly reduce the amount of money workers take home.

By cutting taxes on tips, workers could see an increase in their take-home pay. This extra income could help them cover essential expenses like rent, groceries, and healthcare. For many, it could make a big difference in their daily lives.

This policy is especially relevant now, as the COVID-19 pandemic has had a severe impact on the service industry. Many workers have faced reduced hours, layoffs, and closures of businesses. A tax cut on tips could provide much-needed relief to those who are still struggling to recover.

Support and Criticism

The response to Harris’s announcement has been mixed. Many service industry workers and advocates have expressed their support, seeing it as a step in the right direction. They believe that cutting taxes on tips is a fair way to help those who work hard but often struggle to make ends meet.

One restaurant worker in New York City said, “It’s about time someone in Washington thought about us. Tips are a big part of my income, and it would be great to keep more of it.” This sentiment is shared by many who work in similar jobs.

However, not everyone is on board with the idea. Some critics argue that the policy does not address the root problems facing service workers, such as low base wages and job insecurity. They believe that while cutting taxes on tips might provide some relief, it does not solve the larger issues that workers face. Some economists have also expressed concerns about the potential loss of tax revenue and how it might impact government funding for public services.

Looking Ahead

As Harris’s proposal gains attention, it remains to be seen whether it will move forward in Congress. The idea of cutting taxes on tips is popular among many, but it will face challenges as it moves through the legislative process. With support from service industry workers and some lawmakers, there is potential for this policy to become a reality.

For now, Vice President Harris has brought back an idea that many thought was left behind with the Trump administration. By focusing on the needs of service workers, she has tapped into a significant issue that affects millions of Americans. Whether this proposal will lead to actual change remains uncertain, but it has certainly sparked a conversation that is far from over.