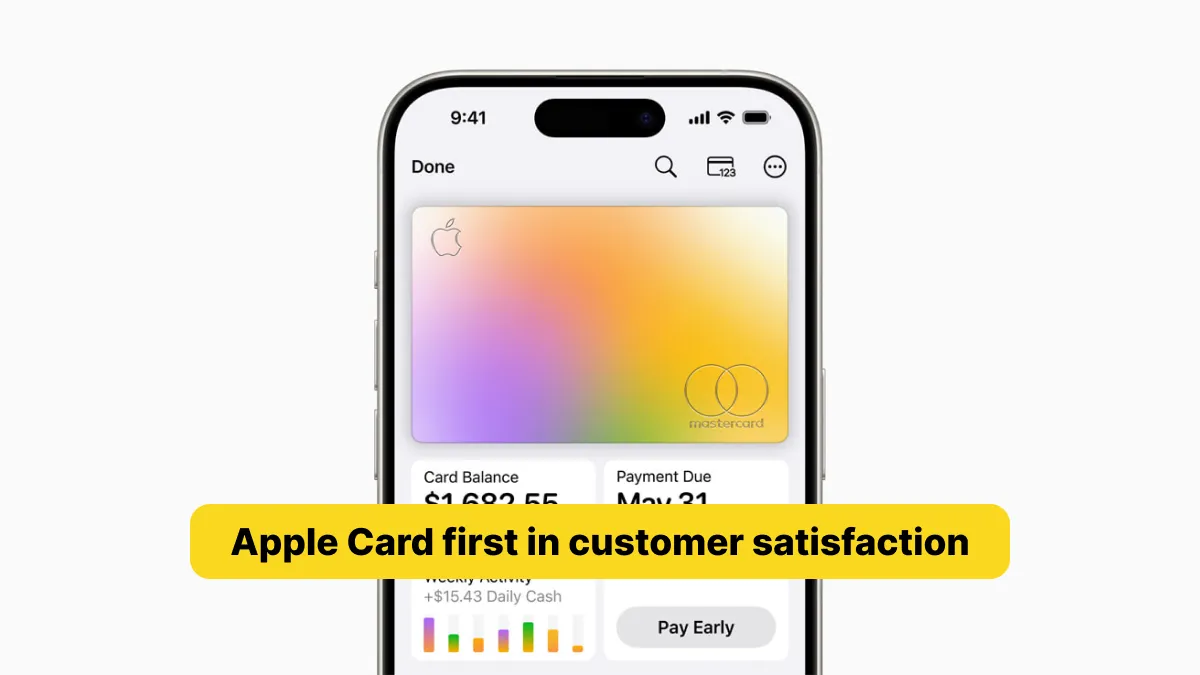

On August 17, 2023, Apple Card took the top spot in customer satisfaction in a J.D. Power survey. The ranking is a major milestone for Apple as it further solidifies the tech giant’s presence in the financial industry. The survey analyzed how satisfied customers were with their credit cards across various factors. Apple Card emerged as the leader in this space, surpassing many long-established financial institutions.

J.D. Power is a well-known market research company that surveys consumers on a wide range of products and services. The company’s credit card satisfaction study is considered one of the most reputable in the industry. This particular study covered six key factors: interaction, credit card terms, communication, benefits and services, rewards, and key moments of truth. These factors are critical in understanding how well a credit card serves its customers. The fact that Apple Card ranked highest shows how well it meets consumer needs.

Apple Card is a relatively new player in the credit card market. Launched in 2019, it was Apple’s first step into the financial sector. The card was designed with the company’s signature focus on user experience and privacy. From the start, Apple emphasized the card’s simplicity, transparency, and ease of use. Apple Card has no fees, offers daily cashback rewards, and integrates seamlessly with the iPhone through the Wallet app. This focus on user-friendly features has clearly resonated with customers.

The survey results highlighted that Apple Card excelled in several key areas, especially in the interaction category. Customers found it easy to use the card, especially through the Wallet app. The app provides users with real-time spending notifications, easy-to-understand transaction summaries, and tools to help manage finances. The card’s integration with Apple Pay also offers a secure and private payment option, adding to customer satisfaction.

Another major factor contributing to Apple Card’s success in the survey is its transparent credit card terms. Unlike many traditional credit cards, Apple Card does not charge late fees, annual fees, or international transaction fees. This transparency has helped build trust among users, which is crucial in the financial services industry. Many customers appreciate the card’s approach to interest rates, which are clearly explained and calculated based on individual payment habits.

Communication was another area where Apple Card scored well. The company is known for its customer service, and the Apple Card is no exception. Users have access to customer support through the Wallet app, where they can quickly chat with a representative. This ease of access and responsiveness has been a key driver in the high satisfaction ratings.

The rewards system offered by Apple Card also played a significant role in its top ranking. Apple Card offers a straightforward cashback program. Users earn 3% cashback on purchases made directly with Apple, 2% on purchases made using Apple Pay, and 1% on all other transactions. The daily cashback feature allows users to access their rewards immediately, which has been well-received by customers. This simplicity and immediacy in rewards are uncommon among other credit cards, making it a standout feature.

In the broader context, Apple Card’s ranking reflects a growing trend of tech companies entering the financial sector and challenging traditional banks. Apple’s success in customer satisfaction with its card may push other tech giants to follow suit. It also puts pressure on established credit card companies to innovate and improve their offerings.

Apple has always been a company that thrives on customer loyalty, and the Apple Card’s success is a testament to that. The tech giant’s reputation for quality and innovation has clearly translated well into the financial services sector. Many industry analysts believe that Apple Card’s performance in the J.D. Power survey will only increase its appeal. As more consumers look for alternatives to traditional banking products, Apple Card’s popularity is likely to grow.

The implications of this ranking are significant. Not only does it validate Apple’s approach to financial services, but it also signals a shift in consumer expectations. Customers are increasingly looking for financial products that are easy to use, transparent, and integrated with technology. Apple Card’s success in this area could prompt other financial institutions to rethink their strategies.

In conclusion, Apple Card’s top ranking in J.D. Power’s customer satisfaction survey is a major achievement. It highlights how well the card meets the needs of modern consumers. The news of this ranking is likely to attract even more customers to the Apple Card, further strengthening Apple’s position in the financial sector. As the landscape of consumer finance continues to evolve, Apple Card is clearly leading the way.